How do you go from being flat broke to achieving — if not wealth — a state of financial security, freedom, and comfort?

One step at a time.

But: Do you know what your next step should be?

I estimate that about 80% of questions I get fall into one category: “What next?” And it makes sense. After you accomplish a financial goal or make a big life change, you often don’t know where to focus your efforts. For example:

- You’re eligible for a 401(k) plan but still have credit card debt. Should you contribute?

- You graduate with a ton of student loans. Do you pay them off early?

- You’ve saved up six months’ living expenses. What now?

As I’ve been thinking a lot about my goals for this site in the upcoming year, I identified the need to start packaging my financial philosophies and advice in ways that are direct and consistent.

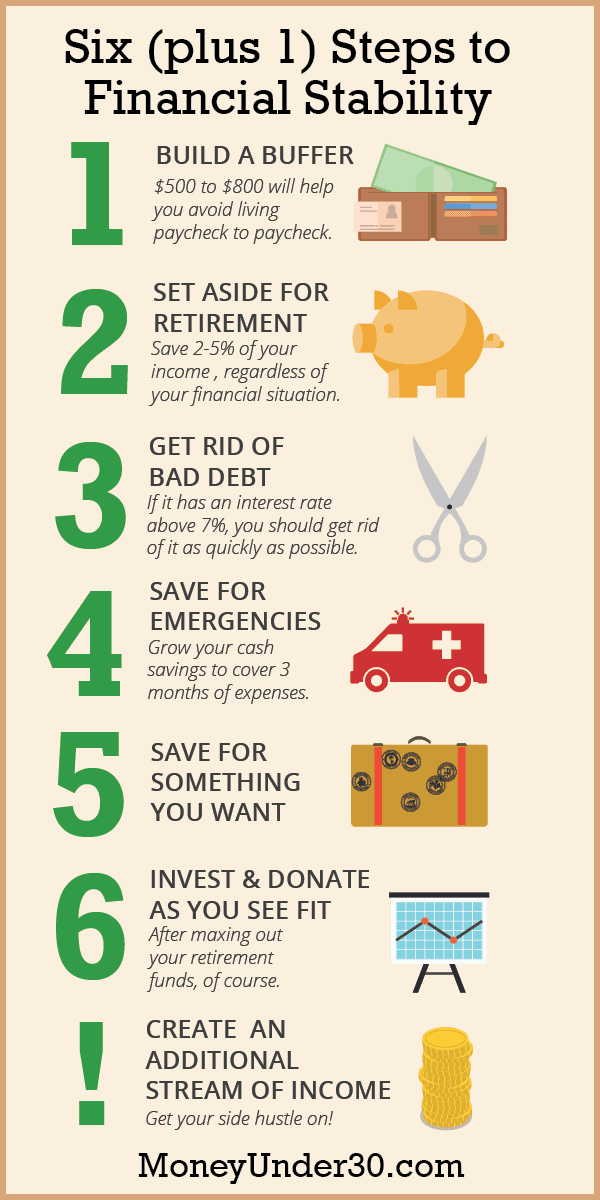

So I give you the 6 + 1 System for achieving financial security.

Writing about money for nearly 10 years now, I’ve not only tested what works in my own life, but I’ve interviewed hundreds of people — including self-made millionaires, investment professionals and plenty of ‘average’ young people who are doing well financially — about the money habits that have had the greatest impact on their wealth.

Not surprisingly, well over 80% of the successful people I’ve interviewed keep mentioning the same simple habits. The result is the 6 + 1 System.

The 6 + 1 System can help you break a cycle of debt or, if you’re further along, the 6 + 1 System will help you prioritize your financial goals to achieve them as quickly as possible.

Enough said; here are the steps:

What’s Ahead:

- 1. Build a ‘Bank Account Buffer’™

- 2. Invest a token amount for retirement

- 3. Get rid of “bad” debt

- 4. Save for emergencies and retirement

- 5. Save for something you want

- 6. Invest and donate as you see fit

- + 1. Create an additional stream of income

- How I arrived at the 6+1 system

- What does it mean to be financially secure?

- Summary

1. Build a ‘Bank Account Buffer’™

Whether or not you’re dealing with credit card or other personal debt, if you’re living paycheck-to-paycheck, one big bill or a week of missed work could be all that separates you from financial disaster. The very first step is to build a Bank Account Buffer™.

The idea of a Bank Account Buffer™ is simple: It’s an amount of money in your checking account that’s between $500 and $800 or two week’s pay (whichever is more). Even though you keep your Bank Account Buffer™ in your checking account, you need to think of that cash as untouchable. Whatever you buffer is — $500, $800, or $1,500 — that amount of money becomes your new “zero”. You should never dip below it.

Building a Bank Account Buffer™ will not only save you from costly overdraft fees but also begin to shift your mindset from always being broke to becoming used to having a financial cushion.

2. Invest a token amount for retirement

This may seem weird, but even if you’re $20,000 in credit card debt, I want you to open a retirement savings account. If you have a 401(k) or other kind of retirement account at work, that’s perfect. Otherwise you’ll need to open an IRA on your own.

Retirement is a vital but often-overlooked part of financial health. Even if you have more pressing money priorities, you want to get into the habit of saving for retirement early. Saving for retirement should be something you never have to think about, and the earlier you do it, the more your money can work for you thanks to compound interest.

If you’re paying down debt, you can start very small — even putting between 2% and 5% of your salary towards retirement is a good start. Once you’re out of debt, you’ll want to increase this percentage substantially.

One final note: If your employer matches contributions to your 401(k) or similar plan, try to contribute the maximum amount they will match. Failing to do so is like leaving a portion of your salary on the table.

3. Get rid of “bad” debt

I don’t really believe there’s such a thing as “good” debt, but some debts are definitely worse than others. Namely: Credit card debt, personal loans, and auto or student loans with an interest rate greater than 6.5%. After you have a Bank Account Buffer™ and are contributing a small amount towards retirement saving, your priority should be to pay off bad debts as fast as possible.

If it’s important to you to save as much money as you can, pay off the debts with the highest interest rate (APR) first. Otherwise, start with the debts with the smallest balances so you can celebrate milestones sooner as you pay them off in full.

What about other student loans and other debt?

Lots of us have student loans that may not qualify as “bad” debt. If you have student loans with an interest rate over 6.5%, I would encourage you to pay them off in Step 3.

If, however, you have federal loans with a 5% or 6% interest rate, that decision is less clear. Personally, I would not pay extra on these student loans. I would continue saving and investing instead.

I don’t know whether I can beat a 5% or 6% rate of return in the stock market, but I would hope to at least match it (in the long run) with the possibility of doing even better. Also, some student loan interest is tax deductible. Finally, if you save money rather than paying off your loans early, you have cash available that provides flexibility should other opportunities arise (in investing or in life).

Ultimately, the decision is yours. If your priority is to become debt-free as soon as possible and you prefer the guaranteed return of paying down your student loans early, there’s nothing wrong with doing so.

4. Save for emergencies and retirement

After you’ve eliminated all high-interest debt, it’s time to turn your sights on savings.

Although a Bank Account Buffer™ can insulate your finances from small unexpected expenses, it’s no substitute for a full emergency fund: A savings account that contains at least three months of expenses (preferably six months).

An emergency fund should be stored in an FDIC-insured high yield savings account that’s separate from your primary bank so you won’t be tempted to spend it.

At the same time as you build your emergency fund, you should be increasing your retirement savings until you’re saving as much as you comfortably can each month. Putting away 10% of your savings is a good start, but if you really want to build wealth, you should strive to eventually be able to save 25% or even a third of your income.

5. Save for something you want

As you increase your savings rate, don’t feel like it ALL has to go towards retirement. In fact, you can feel free to evenly split saving for shorter-term goals and saving for future needs, including retirement.

There’s a lot of life to live between now and retirement. Whether your next goal is a wedding, a vacation, or a down payment on a home, plan ahead so you can pay for your goal with cash, not credit.

6. Invest and donate as you see fit

Have you reached the point where you:

- have no bad debt and

- are saving enough to cover all of your wants in the next few years?

Congrats! Feel good about yourself, because most people rarely get to this point. Now your goal should be to contribute the maximum legal amount to retirement accounts every year. This will maximize your tax savings.

With money left over, you can invest on your own in a taxable brokerage account or pay down lower-interest debts like federal student loans or your mortgage. And, of course, if you haven’t been doing so already, set aside money to give back to charity.

+ 1. Create an additional stream of income

Follow the six steps above and you WILL achieve financial freedom. But depending on how much debt you have an how much you earn, it may take a long time. If you’re serious about accelerating your wealth, the “Plus 1” step in the 6 + 1 System is the most important. The Plus 1 Step is creating a side hustle: Another source of income outside your day job.

Earning more money will always be a quicker way to your financial goals than trying to spend less.

For some, your side hustle could grow into a business that will earn you more money than you ever could as an employee. But a full-time business doesn’t have to be your goal.

Lots of millennial are getting ahead by freelancing or working second jobs. Some do it because they have to, but others do it because they know they’re knocking down financial goals in half the time.

When I was 25, I was $80,000 and had a day job that paid about $35,000 a year. At that salary I was keeping my head above water, but it was going to take 10 years or more to get out of debt. So I got side hustles. First, I started working nights and weekend at Starbucks. Later, I learned how to earn money from my hobby as a blogger. With not one but three sources of income, I got out of debt in about three years instead of 10.

Anybody can pursue a side hustle. Here are nearly three dozen ideas to get you started.

How I arrived at the 6+1 system

You may be familiar with Dave Ramsey’s Baby Steps, which, in part, inspired this list. His steps have helped a lot of people, but like all canned advice (including my own), they’re not going to fit everybody.

In creating my own steps, I thought carefully about today’s 20- and 30-somethings who:

- Are starting from scratch, often with modest incomes.

- Have ever-increasing student loan debt loads.

- Cannot rely upon social security and pensions to provide retirement income.

- May not own a home or have kids for many years.

The 6 + 1 System is designed to create financial stability and security by building cash savings for emergencies, making saving for retirement a habit as soon as possible, eliminating consumer debt, and learning to save and invest for specific life goals.

The system doesn’t specifically focus on things like paying down a mortgage or saving for children’s education because those steps don’t apply to many of us (at least not yet).

Finally, you might be surprised to see the emphasis I place on retirement savings. After all, I recommend you start putting something away in a retirement account even if you have credit card debt and then contribute to a Roth IRA at the same time you save for emergencies!

What gives?

Basically, I know so many people working through retirement because they didn’t save earlier in life. And I also know that only about 10% of my friends are actively saving for retirement. All of this DESPITE the fact that every dollar you save in your twenties will grow exponentially thanks to compounding interest. So I think you should start saving for retirement. Start small, but start now.

Basically, we should ALWAYS be saving for retirement IN CONJUNCTION with all our other financial goals.

What does it mean to be financially secure?

First, watch our quick 2-minute video about personal finance trends to avoid.

To me, financial security means:

- Not carrying consumer debt.

- Having a back-up plan if you lose your primary source of income (at least an emergency fund and maybe a second income stream).

- Regularly saving and investing money for the future.

I wrestled with what to call this post. In other words, what the ultimate outcome of these 6 plus 1 steps should be.

At first, I was going to call them steps to financial independence, but that’s not right; financial independence means different things to different people. For many, it simply means not relying on mom and dad to pay some of your bills, so in that sense, you could technically be financially independent but still have no savings and tons of debt.

In the personal finance world, financial independence (or financial freedom) has another meaning: it’s when you can live solely off the interest on your investments. In other words, you no longer have to rely on working for your income. That’s a much bigger goal.

I settled on financial security because I think it is

- Something we all want

- A milestone that will make you significantly happier

- It’s achievable for most people, regardless of income

To be clear, we’re not talking about getting filthy rich here. Somebody making $10 an hour can become financially stable just as much as somebody making $100 an hour. But once you achieve financial security and stability, you will:

- Worry about money less, if at all

- Earn interest rather than pay it

- Grow wealthier by the day, almost automatically

Finally, you’ll be richer than most people. Less than 40% of Americans have enough savings to cover three months’ living expenses, according to a study by Bankrate.com. When you can combine a rainy-day fund, no debt and regular retirement savings, you’ll join a rather exclusive club!

Summary

Financial security means having enough money saved to cover significant unexpected expenses or the loss of you income for at least six moths. In addition, people who are financially secure typically do not have consumer debt and can consistently save money for future needs while meeting all their monthly financial obligations.

To achieve financial security, you need to begin hanging onto money that you don’t spend, paying off high-interest debt, and saving money strategically for different goals: An emergency or rainy day fund, retirement and eventual financial independence, and things you want. To accelerate your progress, it helps to focus not only on ways you can save money, but also ways you can earn more, such as pursuing a higher-paying career or developing a business in which you can earn money on the side.