After years of speculation and debates, President Biden finally announced that he’d be fulfilling a campaign promise to cancel some student debt.

The plan could bring relief to over 43 million borrowers with an average $30,000 debt outstanding.

So, do you qualify for Biden’s student loan forgiveness plan? How much of your debt will be forgiven? How will it affect your monthly payments, and what relief is there for future borrowers?

Here’s everything you need to know about Biden’s student loan forgiveness plan!

What’s Ahead:

- Biden’s student loan forgiveness plan

- December 2022 update

- Who exactly qualifies?

- Which loan types qualify?

- Will I get the full amount? Or is there a sliding scale?

- What steps do I have to take? Or is it automatic?

- How will student loan forgiveness affect my remaining monthly payments?

- What about the updates to the income-driven repayment (IDR) plan?

- Will I have to pay taxes on my student loan forgiveness?

- Will the student loan repayment freeze be extended (again)?

- Should I hold off on refinancing until forgiveness kicks in?

- I paid off my loans during the freeze. Is there any kind of relief for me?

- I haven’t applied for student loans yet. Is there any relief for future borrowers?

- The bottom line

Biden’s student loan forgiveness plan

On Aug. 24, President Biden announced that the federal government would forgive $10,000 in student loan debt for qualified borrowers making under $125,000 as a single filer or $250,000 as a household.

If you received a Pell Grant, you could qualify for an extra $10,000 in forgiveness.

Biden also proposed a new income-driven repayment (IDR) plan that would lower payments on undergraduate loans from 10% or 15% of your monthly discretionary income to just 5%.

Overall, the Biden administration estimates the new plan will provide relief for up to 43 million borrowers. Here’s the full White House Fact Sheet.

December 2022 update

Now, if you were looking forward to having up to $20,000 of your student loans forgiven, you might feel deflated by some recent, grim-sounding headlines.

Headlines featuring words like “Lawsuit,” “Challenged,” and “Frozen.”

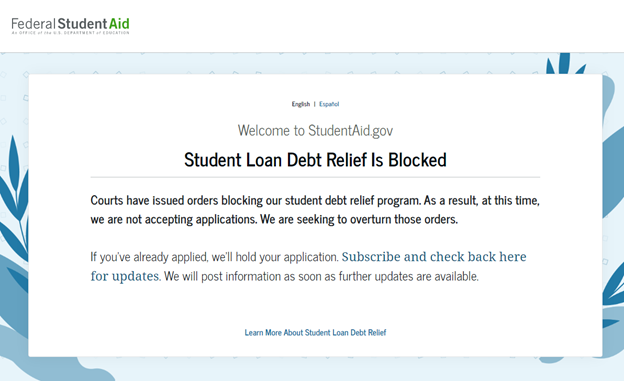

I was actually speaking to a group of college students about financial wellness right as the program was blocked. I was explaining how the program was in legal jeopardy, and that anyone interested should apply ASAP when a student politely raised his hand and said:

“Uh… the site is down right now.”

Source: Studentaid.gov

TL;DR: What happened?

The program is facing two high-profile lawsuits: one from six Republican-led states, and one from a pair of borrowers who didn’t qualify for full relief. As a result, student loan relief can’t proceed until both suits play out in court sometime next year.

In other words, it’s in limbo and nobody has received relief yet.

Who’s trying to block student loan forgiveness, and why?

Well, as you might recall, not everyone was happy to hear about Biden’s program. Some called it a Band-Aid on a bigger problem, and others said it was straight up unlawful.

But most of the students I spoke with didn’t care too much for the overarching politics. I’ll just take my $10k, thanks. They were among the 26 million who applied for relief before the site went down, 16 million of which had already been approved by the Biden administration.

Unfortunately, before the $400 billion relief train could arrive at the station, a federal judge based in Texas yanked on the brakes. U.S. District Judge Mark Pittman struck the program down on Nov. 10, barring its implementation and forcing an indefinite hold on new applications.

Judge Pittman was acting on behalf of a lawsuit filed by conservative interest group the Job Creators Network Foundation, which itself wrote up the suit based on complaints filed by two borrowers. One didn’t qualify for relief because her loans were privately held, and the other complained he was only eligible for $10,000 because he wasn’t a Pell Grant recipient.

The lawsuit alleges that the program unlawfully skipped right over the step where citizens provide feedback on proposed federal programs — a rule made sacred by the Administrative Procedure Act.

“This ruling protects the rule of law which requires all Americans to have their voices heard by their federal government,” said Elaine Parker, president of Job Creators Network Foundation.

“The program is thus an unconstitutional exercise of Congress’s legislative power and must be vacated,” wrote Judge Pittman.

So that’s big lawsuit/roadblock no. 1.

Big lawsuit/roadblock no. 2 comes from six whole states. GOP-led Arkansas, Iowa, Kansas, Missouri, Nebraska, and South Carolina collectively filed a lawsuit challenging Biden’s authority to cancel student debt. Technically their complaint preceded Judge Pittman’s, but wasn’t granted a preliminary injunction (read: taken super seriously) until Nov. 14.

Though both lawsuits have the same throughline — that this is an overreach of executive power — the Republican-led states also add that this high amount of debt relief could negatively impact tax revenue.

This echoes several earlier lawsuits that were eventually thrown out. One came from a Wisconsin taxpayers group alleging that this would dip too far into the U.S. Treasury. Another came from Arizona Attorney General Mark Brnovich, who asserted that the plan would hurt recruitment of public sector employees by erasing incentives provided by Public Service Loan Forgiveness.

In short, a lotta folks are trying to block Biden’s student loan forgiveness program. And while most lawsuits have fizzled out in the lower courts, the two big suits described above made it through the gauntlet and pose a real threat to the program’s survival.

So what happens now?

Well, it could take weeks or months for these two big lawsuits to play out in court. And until then, the 8th U.S. Circuit Court of Appeals has blocked the Biden Administration from providing a penny of debt relief — or even taking new applications.

That said, the program isn’t canceled; it’s just on pause until litigation gets resolved. It’s entirely possible that these suits will fizzle out just like the others, and that you’ll get your $10k or $20k by mid-2023.

It’s also possible that these efforts will succeed and student loan forgiveness will be blocked indefinitely. Or that the lawsuits will be drawn out until 2024.

Point being, hope for the best and plan for the worst.

What about repayment extensions?

If there’s a silver lining for borrowers, it’s that the program’s legal challenges gave Biden the opening to further extend the pause on repayments.

On Nov. 28, he announced that federal student loan payments would be paused until 60 days after the lawsuits are resolved. They were previously scheduled to resume on Jan. 1.

As a borrower, what steps should you take as you wait?

Here are four steps every borrower can take as you wait for all this to be resolved:

- Read the rest of this guide — As of now, the terms of the original plan are exactly the same. So be sure to educate yourself on whether or not you qualify and for how much.

- Subscribe to updates — The U.S. Department of Education has two newsletters I’d recommend: Federal Student Loan Borrower Updates and Top News from the Department. They’re the top two on this list.

- Don’t plan on receiving relief — There’s nothing wrong with crossing your fingers, but don’t plan your 2023 budget around debt relief since it isn’t guaranteed.

- Shrink your debt in other ways — Check out our guide on how to manage student loan debt for ways to manage your debt and pay it off faster.

Who exactly qualifies?

Here are the qualifications for receiving $10,000 in student loan forgiveness:

- You’re a single filer with an adjusted gross income of under $125,000 on either your 2020 or 2021 tax returns. For joint filers or heads of household, that number rises to $250,000.

- You took out a federal student loan, including PLUS loans. Loans taken out by you or your parents on your behalf both qualify.

- You took out your loan prior to June 30, 2022.

If you meet the above requirements and you received a Pell Grant, you may qualify for an additional $10,000 in relief for a total of $20,000.

Which loan types qualify?

Most types of federal student loan debt qualify. That includes:

- Direct loans (subsidized and unsubsidized)

- Direct PLUS loans, including Grad Plus and Parent Plus loans

- Direct consolidation loans

- Some (but not all) Federal Family Education Loans

The trick with Federal Family Education Loans (FFEL) is that some are held by private companies. If your FFEL qualified for the payment pause in 2020, it may qualify for forgiveness. If it didn’t qualify for the payment pause, that’s a sign that it’s privately held and won’t immediately qualify for the $10,000.

That being said, there’s still hope. The Washington Post reports that the Biden Administration is working with private FFEL lenders to see if they can fold their borrowers into the relief program.

Will I get the full amount? Or is there a sliding scale?

If you meet the above qualifications, you will get the full $10,000 in forgiveness ($20,000 for a Pell Grant).

There is no sliding scale based on income, or anything like that.

What steps do I have to take? Or is it automatic?

It depends.

If the Department of Education already has your income information from 2020 and/or 2021, you’ll automatically qualify. According to the Biden administration, they already have income information from 8 million out of 43 million qualified relief candidates.

If you qualify but you’re not sure if the DoE has your income information, you’ll soon be able to fill out a form that certifies your qualification.

The form is scheduled to release sometime between now and when the repayment freeze expires. You can subscribe here for Department of Education updates — be sure to check the first box for Federal Student Loan Borrower Updates.

You’ll also want to double-check that your loan servicer has your latest contact and address information. If you’re not sure who your loan servicer is, check here on the DoE’s official page.

How will student loan forgiveness affect my remaining monthly payments?

It kind of depends on how your loan servicer wants to interpret the loan forgiveness program. At the time of this writing, we’re not sure if the bulk of them will choose to:

- Lower the amount you have to pay each month, or

- Keep your monthly payments the same and shorten your term.

They may end up letting borrowers choose, but again, who knows? The New York Times asked Scott Buchanan, executive director of Student Loan Servicing Alliance, what borrowers should expect. His response was basically:

“¯\_(ツ)_/¯ “

We do know that if you’re on an income-driven repayment (IDR) plan, any amount of forgiveness you receive probably won’t shrink your monthly payments since your payments are income-based, not balance-based.

That being said, Biden has big changes in store for IDR plans, too.

What about the updates to the income-driven repayment (IDR) plan?

If you’re on an IDR plan like PAYE, REPAYE, ICR, etc., you’re probably used to paying 10%, 15%, or even 20% of your discretionary monthly income towards your student loan balance.

While capping your required payments is helpful, even 10% can be pretty steep for low-income borrowers struggling to make ends meet as the cost of living rises.

Read more: How little can you live on in 2022?

That’s why the Biden administration has proposed a new rule that would cap monthly payments at 5% of your monthly discretionary income versus 10% or higher. The new rule would also raise the amount considered “non-discretionary” and forgive balances after 10 years of payments instead of 20.

The rule is expected to take effect in summer 2023.

Will I have to pay taxes on my student loan forgiveness?

Nope! Congress eliminated taxes on loan forgiveness through 2025.

Will the student loan repayment freeze be extended (again)?

Yep!

The student loan repayment freeze that began in 2020 was originally slated to expire on Aug. 31, 2022, then bumped to Dec. 31, 2022, has now been extended again pending the lawsuits.

Payments are paused until 60 days after the lawsuits are resolved. If that hasn’t happened by June 30, 2023, payments will resume on Sept. 1, 2023.

Should I hold off on refinancing until forgiveness kicks in?

Oh, most definitely.

Generally speaking, refinancing your federal student loans with a private lender only makes sense when you qualify for a much lower interest rate than you’re currently paying, as is often the case when your credit score rises.

But private loans often lack some or all of the protections of federal loans, such as payment freezes and income-driven repayment plans. That’s why refinancing federal student loans with a private lender should be a careful, calculated decision.

Check out our full guide on student loan refinance options for more info.

And even if you qualify for a lower interest rate — say, 3% versus 7% — that’s not enough to offset $10,000 in instant forgiveness. Wait for the Department of Education to knock $10k off your principal, and then reassess your options.

I paid off my loans during the freeze. Is there any kind of relief for me?

Actually, yes!

If you:

- Meet the qualifications for loan forgiveness, and

- Made student loan payments after March 13, 2020,

you’re actually eligible for a refund! The Department of Education advises that you contact your loan servicer to request your refund and get the ball rolling.

I haven’t applied for student loans yet. Is there any relief for future borrowers?

There’s no direct monetary relief for borrowers who took out loans after June 30, 2022, or plan to in the future. That means if you borrow $50,000 this fall, you won’t automatically get a $10,000 discount on your principal.

That being said, the Biden administration claims that three new policy adjustments can improve the outlook for future borrowers:

- Setting an income-driven repayment plan at 5% instead of the standard 10% to cut required monthly payments in half

- Fixing the “broken” Public Service Loan Forgiveness program to broaden who qualifies for forgiveness, and overall streamline a complex and messy system

- “Holding schools accountable when they hike up prices,” thereby strengthening overall accountability “to ensure student borrowers get value for their college costs”

For more on how to make college more affordable, check out:

The bottom line

If Biden’s plan means you’re suddenly debt-free, you might start having a little extra capital at the end of the month to invest.

So where should you put it?

Well, you’re definitely in the right place to find out! Check out:

- How to invest: Essential advice to help you start investing

- How the rich get rich (and how you can, too!)

Featured image: eamesBot/Shutterstock.com