Bills are an inevitable part of “adulting.” So we might as well do what we can to earn some rewards for paying them.

Utilizing credit cards for bill payments is a great way to do just that.

The best credit cards for paying your bills offer competitive rewards, good interest rates, and perks that are relevant to your lifestyle. The guide below covers the best cards for bill payments and other recurring expenses.

What’s Ahead:

- Overview of the best credit cards for bill payments

- Best for everyday use: Capital One Quicksilver Cash Rewards

- Best 0% introductory APR: Chase Freedom Unlimited®

- Best for travel rewards: Capital One Venture Rewards

- Best for building credit: OpenSky® Secured Visa® Credit Card

- Best for small businesses: Ink Business Cash® Credit Card

- What to look for in a credit card for bill payment

- How to save money on monthly bills and utilities

- Summary

Overview of the best credit cards for bill payments

There’s no single best credit card for bills — it depends on your lifestyle and how you use credit. Here’s an overview of some of the best options based on their unique benefits and perks.

Best for everyday use: Capital One Quicksilver Cash Rewards

Best 0% introductory APR: Chase Freedom Unlimited®

Best for travel rewards: Capital One Venture Rewards

Best for building credit: OpenSky® Secured Visa® Credit Card

Best for small businesses: Chase Ink Business Cash® Credit Card

Each of these cards — covered in more detail below — can help you earn rewards on your bills, are flexible in terms of when you need to repay your debts, and offer various perks.

Best for everyday use: Capital One Quicksilver Cash Rewards

In A Nutshell

The Capital One Quicksilver Cash Rewards Credit Card is a great credit card for everyday expenses, including bills and utilities. It’s a simple card that earns a flat 1.5% back on all purchases, offers a sign-up bonus, and even has a 0% APR introductory offer for 15 months.

Credit Score Requirements

Very good to excellent

What I Like

- Simple cash back rewards.

- 1.5% back on all purchases.

- $200 cash bonus once you spend $500 on purchases within 3 months from account opening

The Capital One Quicksilver Cash Rewards credit card is valuable for many people. It has no annual fee, a competitive rewards rate (1.5% on all purchases), and a generous $200 cash bonus once you spend $500 on purchases within 3 months from account opening.

I recommend the Quicksilver as your “daily driver” credit card. If you don’t want to bother with bonus categories or complicated travel rewards programs, this card is for you. It’s simple, with no frills and no hassle. And there’s no annual fee.

This is also a good card if you plan to carry a balance or you want to do a balance transfer. The card offers 0% APR on new purchases and transfers of existing credit card balances for 15 months. After the introductory period, the APR will return to 19.74% - 29.74% (Variable).

Best 0% introductory APR: Chase Freedom Unlimited®

In A Nutshell

The Chase Freedom Unlimited® is a no-annual-fee credit card offering 0% Intro APR on Purchases for 15 months and balance transfers. This makes it a good option if you have existing credit card debt or plan to carry a balance. Plus, it offers a solid rewards earning rate of 1.5% back on every purchase.

Credit Score Requirements

Good to excellent

What I Like

- 0% Intro APR on Purchases for 15 months (and balance transfers)

- 1.5% back on all purchases (and even more on drugstores, dining out, and select travel).

- Unique sign-up bonus offers an extra 1.5% on all purchases (up to $20,000 spent in the first year)

The Chase Freedom Unlimited® credit card is a great all-around credit card. It’s particularly handy during the first year because it offers 0% Intro APR on Purchases for 15 months (and balance transfers). That means you can carry a balance (or transfer over a balance from another card) and pay no interest for those months! (APR is 19.74% - 28.49% Variable after introductory period ends).

It’s also a no-annual-fee credit card, which helps keep costs down. And for each purchase, you’ll earn 1.5% back. Then there are bonus categories: 3% back on drugstores and restaurants and 5% back on travel booked through the Chase Ultimate Rewards® travel portal.

And it’s even better during the first year: earn an additional 1.5% on all purchases (up to $20,000 spent in the first year).

The Chase Freedom Unlimited® card offers other perks in addition to its great rewards. There’s purchase protection, extended warranty coverage, free credit score-monitoring tools, and even travel benefits, like trip cancellation coverage.

Best for travel rewards: Capital One Venture Rewards

In A Nutshell

If you’re a frequent traveler, the Capital One Venture Rewards Credit Card is well worth the $95 annual fee. This card earns 2x miles on every purchase and comes with a substantial sign-up bonus.

Credit Score Requirements

Very good to excellent

What I Like

- Huge sign-up bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening

- 2 miles on all purchases and 5 on hotels/rental cars booked through Capital One.

- Travel perks like lounge access and no foreign transaction fee.

The Capital One Venture Rewards credit card is excellent for traveling. It does have a $95 annual fee, but for anyone who travels frequently, the cost is well worth it.

First, this card has a massive sign-up bonus: 75,000 miles once you spend $4,000 on purchases within 3 months from account opening.

There are ongoing perks with this card, as well. For example, cardholders can get airline lounge access, a statement credit to help pay for Global Entry or TSA PreCheck®, and more. And there’s no foreign transaction fee, making the Venture one of the best credit cards for international travel.

The Venture card would be an excellent card to use for your next trip or your everyday expenses. Using it will help you earn consistent rewards that can reduce the cost of your next flight or hotel stay — and points are straightforward to redeem for just about any travel purchase.

Best for building credit: OpenSky® Secured Visa® Credit Card

In A Nutshell

The OpenSky® Secured Visa® Credit Card is perfect for folks who are just starting to build credit and want to improve their credit score. It’s easy to get approved for, even if you don’t have great credit (or have a minimal credit history).

Credit Score Requirements

Poor or better

What I Like

- Easy to get approved for (87% approval rate overall).

- Each payment is reported to the credit bureaus, which helps you build credit.

- Low fees and low minimum deposit ($200).

The OpenSky® Secured Visa® Credit Card is designed to help you build credit. It’s a secured credit card with a small cash deposit. When approved, you’ll have to make a small cash deposit into an account that stays locked. You’ll then be given a credit limit corresponding to the deposit amount.

Once the card is open, it works like a regular credit card. You can use it to pay bills or buy groceries — or anywhere else that Visa cards are accepted. This card also has a $35 annual fee.

The purpose of a secured card like this is to help you build a positive credit history. Each payment you make toward it will be reported to the credit bureaus and contribute to your credit score. As a bonus perk, if you use the card responsibly for six months, the card issuer will consider you for a credit line increase.

Best for small businesses: Ink Business Cash® Credit Card

In A Nutshell

The Chase Ink Business Cash® Credit Card is great for small business owners. It earns 5% back on certain bills, like cell phone services, internet, and cable — which can add up fast. Plus, there’s a great sign-up bonus!

Credit Score Requirements

Good to excellent

What I Like

- 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Chase Ultimate Rewards® points for cash, gift cards, and more.

- $750 bonus cash back after you spend $6,000 on purchases in the first 3 months after account opening.

The Chase Ink Business Cash® credit card is designed for small business owners, entrepreneurs, and freelancers. To get approved for it, you’ll need to have some sort of business — whether a full-blown business or more of a side hustle. If approved, this is one of the best credit cards for bill payment.

Why? Well, it earns 5% cash back per $1 spent on qualifying phone, internet, and cable bills, up to a maximum of $25,000 in spending per year. It also earns 5% cash back at office supply stores, 2% cash back at gas stations and restaurants (up to $25,000 per year), and 1% cash back on everything else.

This card earns Chase Ultimate Rewards® points, a flexible rewards currency that can be used for travel, cash, gift cards, and more. In addition to its high earning rates, the card offers $750 bonus cash back after you spend $6,000 on purchases in the first 3 months after account opening.

What to look for in a credit card for bill payment

The best credit cards for paying bills offer good rewards, competitive interest rates, solid perks, and a versatile set of uses. Here’s what to pay attention to when selecting the right card for your needs:

Good rewards

It’s always nice to earn rewards on everyday spending, like bills. A good rewards credit card will earn either cash back or points/miles on each purchase you make. Usually, you can expect to earn around 1–2% back ($1 to $2 for each $100 you spend).

Competitive interest rates

You only pay interest if you don’t pay your credit card off in full each month. So, if you tend to carry a balance, selecting a card with a competitive annual percentage rate (APR) is wise. This can help minimize the cost of borrowing money using your credit card.

Useful credit card perks

Many cards offer perks that can be helpful for your everyday life, travel, and more. For instance, some offer extended warranty coverage on items you purchase or benefits like free rental car collision coverage when you travel. While these perks might not benefit you directly when you’re paying bills, they can still be useful.

Versatility

It’s also a good idea to choose a versatile credit card suitable for paying various expenses. Good features to look for might include good rewards (on all purchases), purchase protections, and perks that are relevant to your day-to-day life.

A low annual fee

Finally, you probably don’t want to pay a sky-high annual fee. Many of the best bill payment credit cards discussed above are no-annual-fee credit cards. Sometimes, it’s worth paying a fee — but only if the card’s perks outweigh its cost.

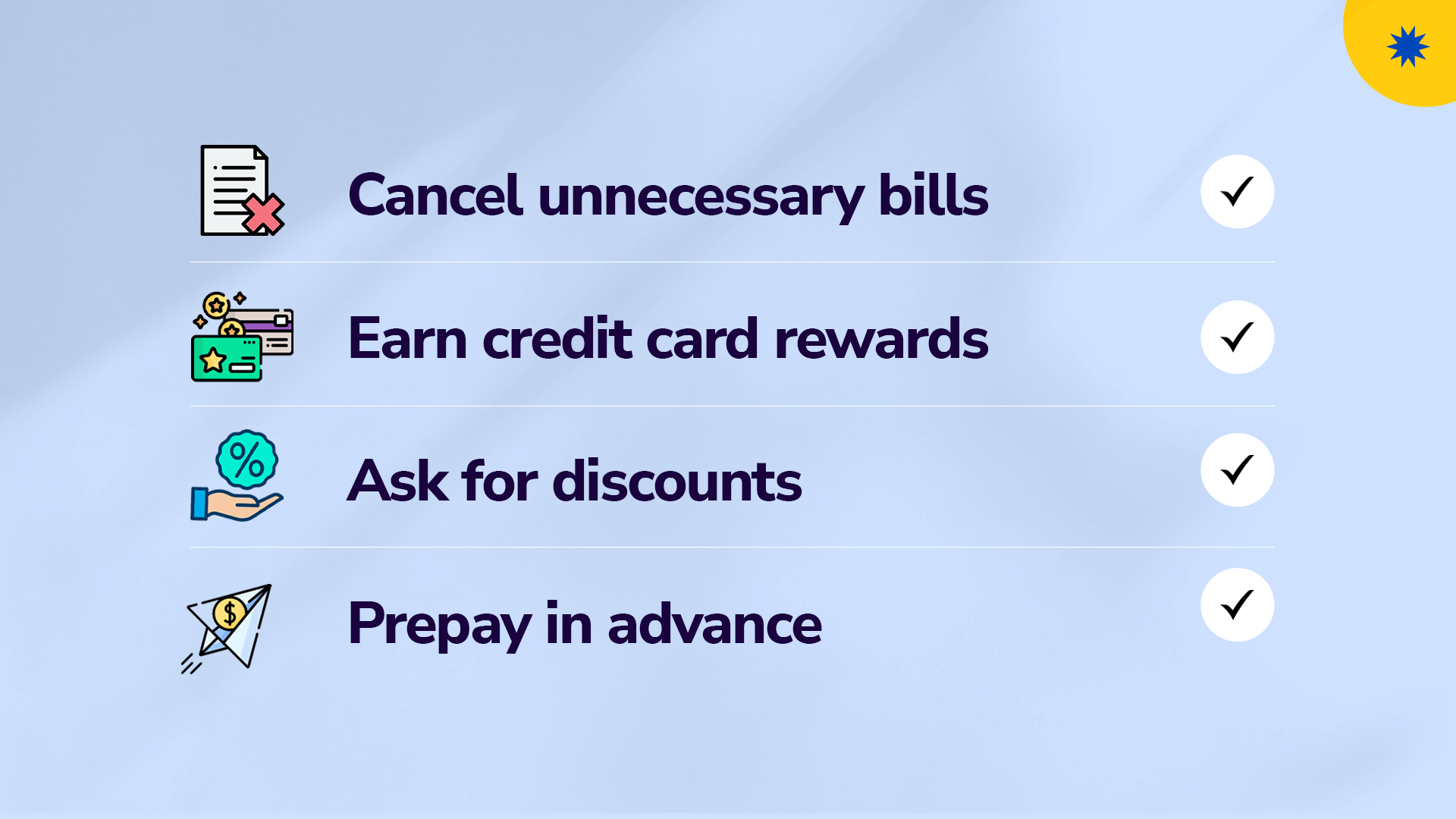

How to save money on monthly bills and utilities

We all have bills, and paying them is not much fun. However, there are a few things we can do to help.

Cancel unnecessary bills

First, look closely at what you’re paying for every month and whether you need those services. For example, maybe you have three streaming services and could cut back to two, or perhaps you’re paying for a gym membership at a facility you don’t often use. Or maybe you could switch from a cable plan with 100 channels to one with 60.

Earn credit card rewards

Paying your utilities and bills with a credit card can help you earn rewards. Earning rewards on monthly bills can add up. Consider this: if you have $500/month in bills that can be paid with a credit card and earn 2% back, that’s an extra $10 per month in rewards you can earn on autopilot.

Avoid credit card fees (and ask about discounts)

Keep in mind that some merchants may charge an extra fee for using a credit card. Others may offer a small discount if you pay by check or bank transfer. If either is the case, it’s probably most cost-effective to take advantage of the discount and not use a credit card for these payments.

Prepay in advance

In some cases, you can save money by prepaying certain expenses. For instance, your car insurance provider might offer a small discount if you prepay for six months at a time rather than paying month-to-month. Of course, it’s always worth asking the vendor if they offer any discounts.

Summary

The best credit card for bill payment will help you earn rewards on your everyday spending, give you flexibility in paying for your expenses and offer various other perks for your lifestyle and travel goals. The cards reviewed above are the best credit cards available today for your bill payment needs.

Didn’t quite find what you were looking for? Check out this list of the best credit cards for every purpose.